More Tax Cuts Coming?

What happened?

The House Ways and Means Committee has released a draft of Trump's "big and beautiful" tax bill. It will now be reviewed by both House and Senate and soon voted on. Aside of extending the 2016 tax cuts from Trump's first term, it also includes a host of generous new tax cuts, including no tax on tips and corporate capex deductibility

Why does this matter?

-

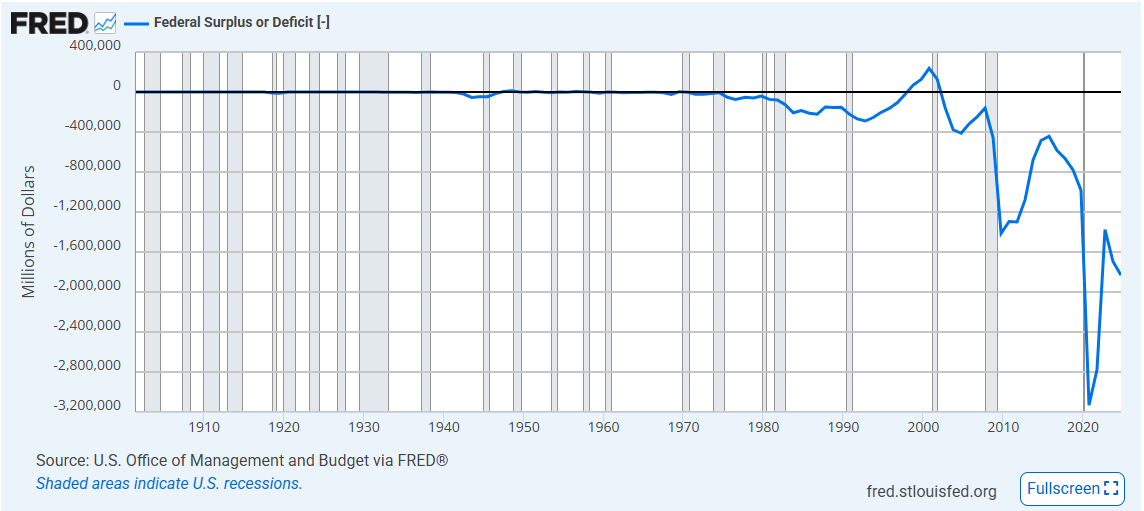

Austerity is over: While Trump's agenda initially focussed on reigning in the US budget deficit, the tax bill returns to the stimulative policies of Trump's first term, funded by debt.

Austerity is over: While Trump's agenda initially focussed on reigning in the US budget deficit, the tax bill returns to the stimulative policies of Trump's first term, funded by debt.

-

The bond market may not like it: Long-term bond yields are drifting higher in spite of recent low inflation readings, suggesting increasing investor concern about spendthrift policies.

The bond market may not like it: Long-term bond yields are drifting higher in spite of recent low inflation readings, suggesting increasing investor concern about spendthrift policies.

What’s the caveat?

-

There is still time to adjust the bill: More budget-conscious members of Congress may raise the voice more loudly in the coming weeks, especially if US Treasuries continue to sell off.

There is still time to adjust the bill: More budget-conscious members of Congress may raise the voice more loudly in the coming weeks, especially if US Treasuries continue to sell off.

-

Productivity gains: For example, due to AI, may create enough economic growth to offset this fiscal expansion.

Productivity gains: For example, due to AI, may create enough economic growth to offset this fiscal expansion.

finformant view

Over the past decade, the US has gotten away with fiscal profligacy that would make any emerging market nation blush. It is not unlikely that this "exorbitant privilege" is now facing difficulties, resulting in a "Liz Truss moment" for Donald Trump.