Retail Investors Are Going All In

What happened?

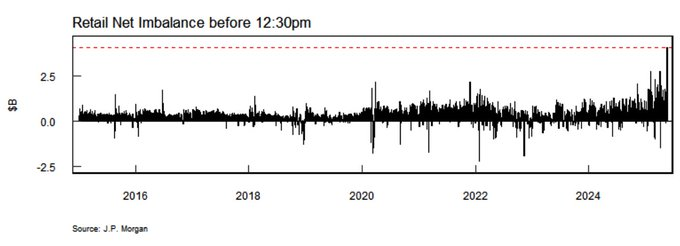

During yesterday's trading session, US retail investors placed a record number of orders as stocks dipped slightly due to Moody's downgrade of US debt. This follows a multi-week buying streak amid the market sell-off caused by tariffs. Meanwhile, institutional investors largely sold, only to be forced to buy back more recently.

Why does this matter?

-

Be fearful when others are greedy: The previous peak in retail buying occurred on April 3, the day after Liberation Day. Stocks sold off significantly afterwards.

Be fearful when others are greedy: The previous peak in retail buying occurred on April 3, the day after Liberation Day. Stocks sold off significantly afterwards.

-

The Yolo society: US asset prices are sky-high, making the American dream of homeownership unattainable for many. Meanwhile, buying the dip has been a successful investment strategy for the past 15 years. Thus, many lower-income groups and millennials now view stock market or cryptocurrency wealth as the only means of achieving their goals. This strategy works until it doesn't.

The Yolo society: US asset prices are sky-high, making the American dream of homeownership unattainable for many. Meanwhile, buying the dip has been a successful investment strategy for the past 15 years. Thus, many lower-income groups and millennials now view stock market or cryptocurrency wealth as the only means of achieving their goals. This strategy works until it doesn't.

What’s the counterpoint?

-

Retail has been the "smart" money before: During the 2020 Covid outbreak, retail investors were net buyers, while institutions were net sellers. The former were rewarded with impressive gains that lasted until late 2021.

Retail has been the "smart" money before: During the 2020 Covid outbreak, retail investors were net buyers, while institutions were net sellers. The former were rewarded with impressive gains that lasted until late 2021.

-

Markets could remain buoyant: A dip caused by buyer exhaustion in the short term doesn't have to signal the end of the bull market. The previous peak of retail euphoria occurred during the Omicron outbreak in November 2021. Although stocks fell afterward, they were higher a month later, though this was followed by a very poor 2022.

Markets could remain buoyant: A dip caused by buyer exhaustion in the short term doesn't have to signal the end of the bull market. The previous peak of retail euphoria occurred during the Omicron outbreak in November 2021. Although stocks fell afterward, they were higher a month later, though this was followed by a very poor 2022.

finformant view

Caution is certainly warranted in the near term for US equities, given their impressive rise from the lows of April.