No Inflation Rebound?

What happened?

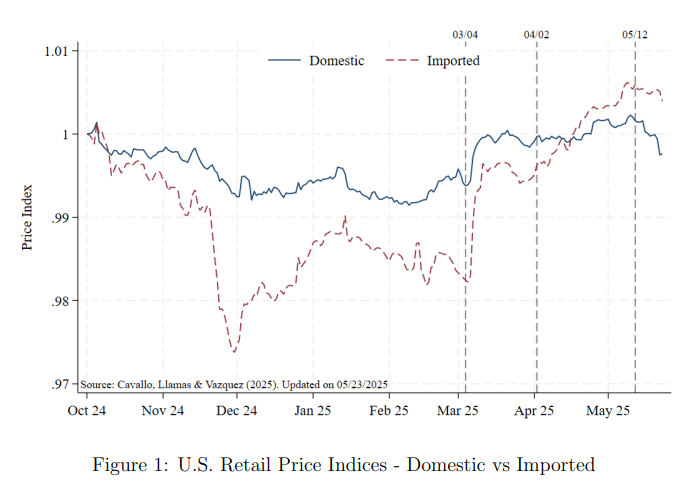

Recent analysis by the Harvard Price Lab, led by experts in inflation dynamics, shows that prices of goods at major US retailers have fallen again, defying expectations of a tariff-driven inflation rebound in the near future.

Why does this matter?

-

The Fed is still on hold due to inflation worries: Should these fears not materialise the path opens to interest rate cuts this summer or fall.

The Fed is still on hold due to inflation worries: Should these fears not materialise the path opens to interest rate cuts this summer or fall.

-

Cost of protectionism may be lower than feared: Corporates absorb tariffs via their margins and/or restructure supply chains, ultimately diffusing much of the impact on the consumer—for now.

Cost of protectionism may be lower than feared: Corporates absorb tariffs via their margins and/or restructure supply chains, ultimately diffusing much of the impact on the consumer—for now.

What’s the counterpoint?

-

US Customs does not enforce properly? The average tariff rate on imports in May was ~6%, below the official blended rate of ~16%. This may be due to lack of enforcement (intentional or not) or importers evading duties by other means, such as transshipment through low-tariff countries.

US Customs does not enforce properly? The average tariff rate on imports in May was ~6%, below the official blended rate of ~16%. This may be due to lack of enforcement (intentional or not) or importers evading duties by other means, such as transshipment through low-tariff countries.

-

Deficit spending may cause inflation either way: Tariffs may be less inflationary than expected, but the "big beautiful" tax bill is still on the horizon and may lead to higher inflation in its wake.

Deficit spending may cause inflation either way: Tariffs may be less inflationary than expected, but the "big beautiful" tax bill is still on the horizon and may lead to higher inflation in its wake.

finformant view

The absence of short-term inflationary pressures is positive for US equities, which still face entrenched skepticism, especially among institutional investors.