Labor Market Report: Good for Stocks, Good for Bonds?

What happened?

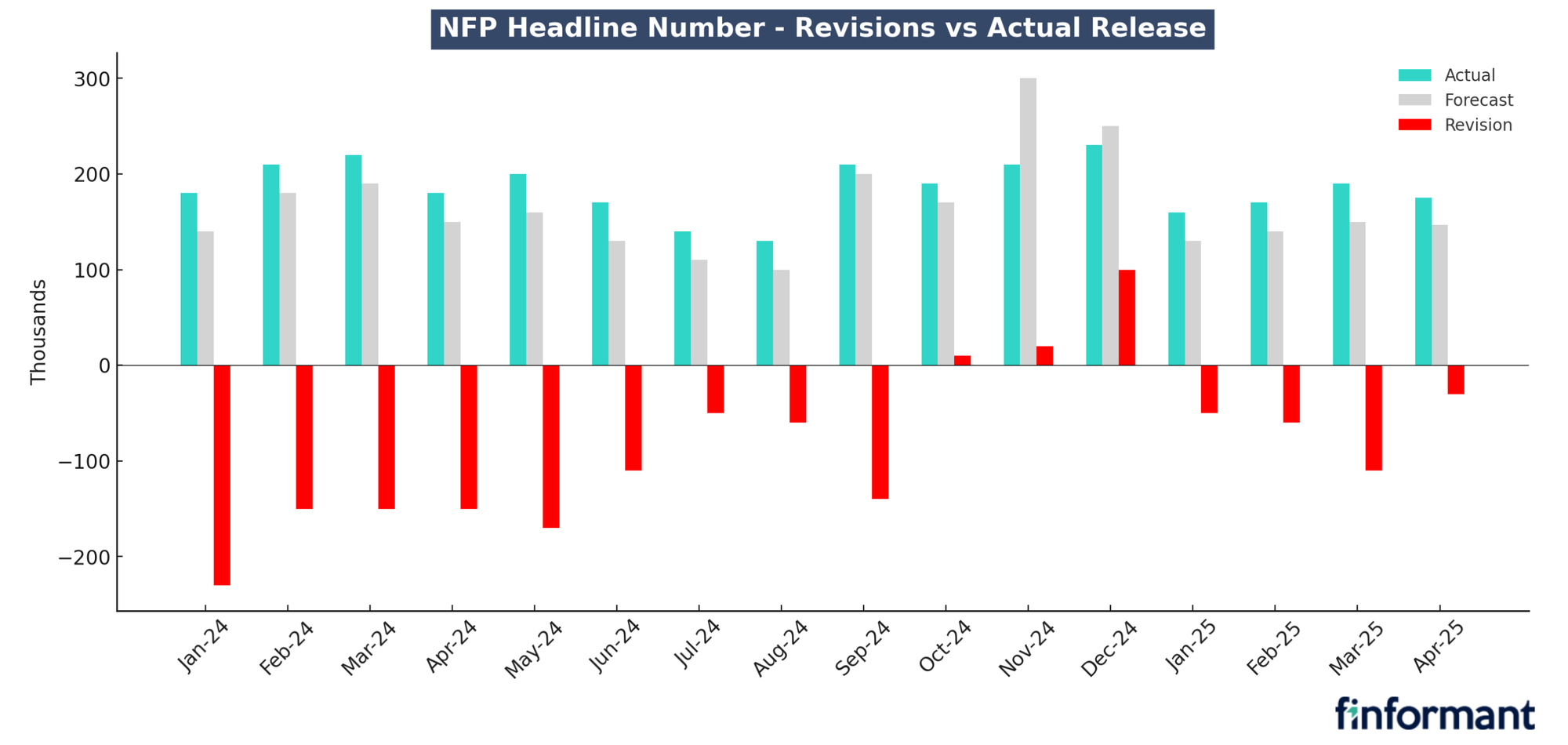

The monthly US employment report was released this morning. Although the headline number showed that 139k new jobs were created in April, the report's details painted a different picture. Data from prior months was significantly revised downward. Along with other recent soft labor market indicators, such as initial claims and ADP's payroll data, this suggests that the US labor market is weakening, though not collapsing.

Why does this matter?

-

Continued signs of slowing US growth: The weakening trend in US employment predated the March/April tariff episode, suggesting an increasingly fragile late-cycle economy.

Continued signs of slowing US growth: The weakening trend in US employment predated the March/April tariff episode, suggesting an increasingly fragile late-cycle economy.

-

Fed conundrum: The Fed faces a difficult set of questions. Should it cut rates now, in anticipation of labor market weakness, as it did in Q3 '24? Or should it wait to see the potential inflationary impact of tariffs, risking the possibility of acting too late?

Fed conundrum: The Fed faces a difficult set of questions. Should it cut rates now, in anticipation of labor market weakness, as it did in Q3 '24? Or should it wait to see the potential inflationary impact of tariffs, risking the possibility of acting too late?

What's the counterpoint?

Although the prospect of a US economic slowdown is becoming harder to deny, the pace at which it will occur remains unclear. The slowdown may be mild enough to give policymakers and the Fed time to respond, potentially softening or reversing the trend.

finformant view

The job report eased concerns about an overheating or accelerating economy, which bodes well for bonds. At the same time, the report offered no indication that growth would plummet, which is good news for equities.