Jobs Data Indicate US Economy May Be Weaker Than Expected

What happened?

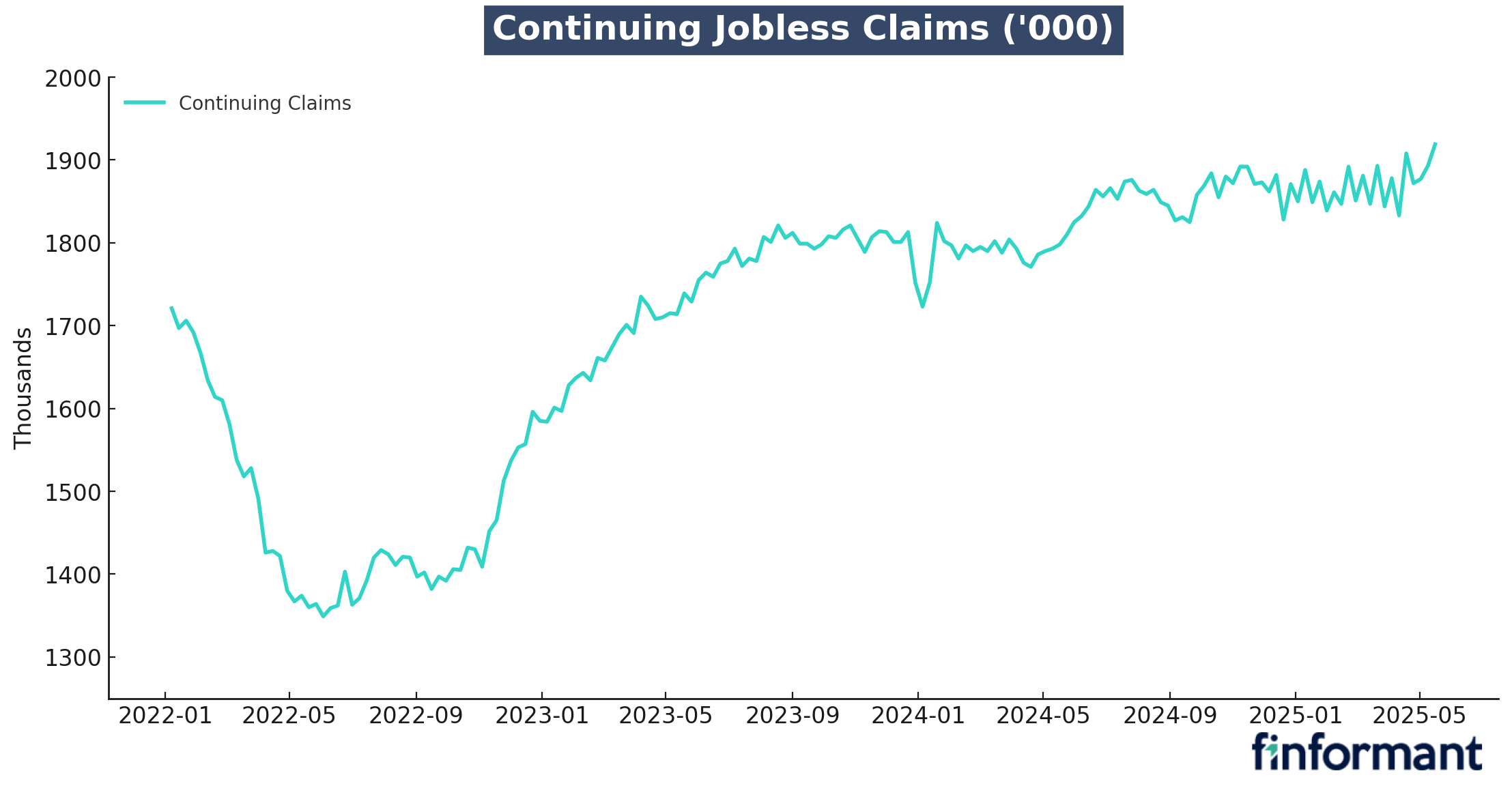

Jobless claims data released today came in higher than expected for the first time in several quarters (240k vs. 230k). Continuing claims, representing those unemployed for more than six weeks, rose to the highest level since 2021. Jobless claims are the key lead indicator for the state of the labor market, and they now corroborate, with hard data, what many consumer surveys have already shown: an increasingly fragile labor market at considerable risk of further weakness.

Why does this matter?

-

Very limited fiscal space: A slowdown in the U.S. economy would put the administration in a precarious position. The deficit is already sky-high, limiting the ability to respond with fiscal generosity.

Very limited fiscal space: A slowdown in the U.S. economy would put the administration in a precarious position. The deficit is already sky-high, limiting the ability to respond with fiscal generosity.

-

Equity and bond markets are offside: The current financial market consensus of a booming U.S. economy may be incorrect. Significant portfolio adjustments would be necessary if a slowdown materializes.

Equity and bond markets are offside: The current financial market consensus of a booming U.S. economy may be incorrect. Significant portfolio adjustments would be necessary if a slowdown materializes.

What’s the counterpoint?

-

Policy unwind can reignite growth: Many of the US admin's recent policy decisions had a negative effect on growth, such as tariffs or the removal of Venezuelan workers. If these are reversed, some growth momentum could be regained.

Policy unwind can reignite growth: Many of the US admin's recent policy decisions had a negative effect on growth, such as tariffs or the removal of Venezuelan workers. If these are reversed, some growth momentum could be regained.

-

AI advances rapidly: Productivity gains from AI are starting to take hold and can boost growth. However, the risk of AI displacing jobs is unclear and may be substantial.

AI advances rapidly: Productivity gains from AI are starting to take hold and can boost growth. However, the risk of AI displacing jobs is unclear and may be substantial.

finformant view

Evidence is growing for a slowing US economy, likely to challenge the current investor consensus of long stocks and short bonds.