Ice-Cold Inflation

What happened?

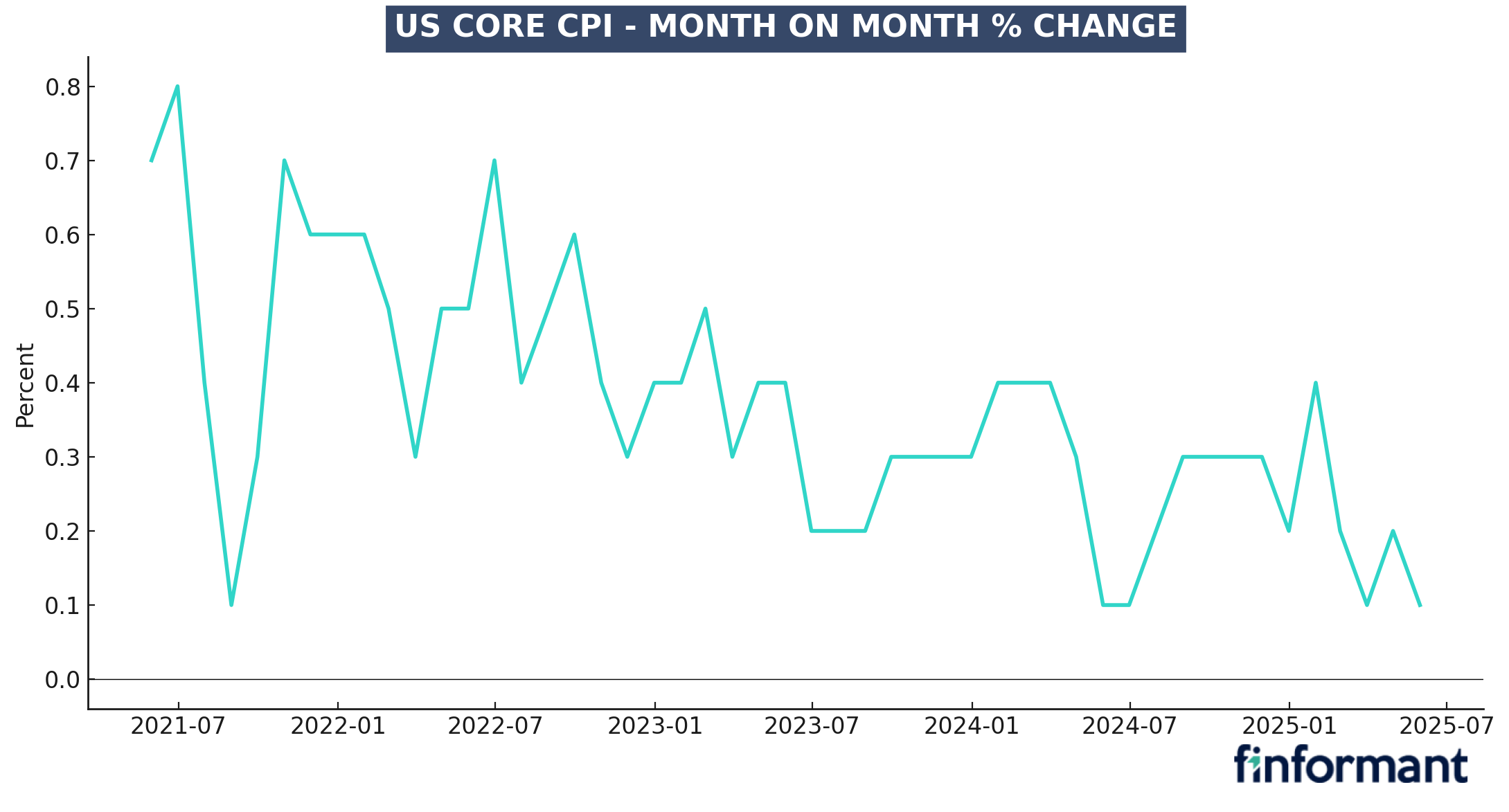

Today's US Consumer Price Inflation release came out with a 0.1% month-to-month increase excl. Energy and Food, or an annualized 1.2%. While prices for some goods rose moderately due to the early tariff impact, the prices of many other components actually declined. This confirms our recent contrarian finformant view that the market overestimated the inflation risk.

Why does this matter?

-

Inflation = corporate topline: The change in goods prices (at a constant volume) equals the growth in corporate revenues. This was clearly lacklustre in May and another indication of a decelerating US economy.

Inflation = corporate topline: The change in goods prices (at a constant volume) equals the growth in corporate revenues. This was clearly lacklustre in May and another indication of a decelerating US economy.

-

Fed under pressure: The Fed has been hesitant to cut rates as it worries about the impact of tariffs. The administration has also heavily criticized the Fed for not cutting rates sooner. Both may lead to a delayed and in fact too late reaction.

Fed under pressure: The Fed has been hesitant to cut rates as it worries about the impact of tariffs. The administration has also heavily criticized the Fed for not cutting rates sooner. Both may lead to a delayed and in fact too late reaction.

-

Corporate margins at risk: The CPI print suggests that corporates absorbed tariffs to some degree as costs. This could make them less hesitant to lay off staff into an already frail labor market.

Corporate margins at risk: The CPI print suggests that corporates absorbed tariffs to some degree as costs. This could make them less hesitant to lay off staff into an already frail labor market.

What’s the counterpoint?

The May CPI could represent a seasonal low, as the full effect of tariffs on retail prices will only be felt from June/July onwards. Higher inflation readings would require consumers to accept these price increases without trading down for other goods and services.

finformant view

Today's US inflation release is another weak data point suggesting the US economy is slowing, perhaps even at a concerning pace. Bonds should be bought and equities sold on the back of this.