Core Voters Thrown Under the Bus by Republican Tax Cut Vote

What happened?

The House passed a bill to extend Trump’s 2017 corporate tax cuts after lengthy negotiations delayed by fiscal conservatives. The tax relief, worth $4.5trillion over 10 years, is half funded by deficits and half by spending cuts, including $1.1 trillion slashed from Medicaid and food stamps. Speaker Johnson secured the narrow GOP majority, marking a tactical win.

Why does this matter?

-

Broken promises: Trump repeatedly vowed to protect entitlements like Medicaid, yet the bill directly targets these programs.

Broken promises: Trump repeatedly vowed to protect entitlements like Medicaid, yet the bill directly targets these programs.

-

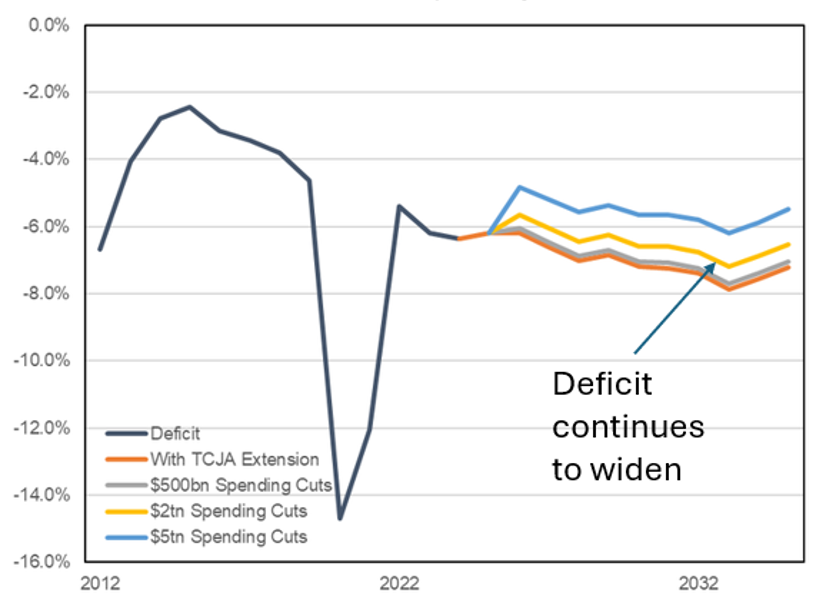

Fiscal duplicity: while touting deficit reduction via DOGE and other means, Republicans rely on a $2.25 trillion deficit increase to finance the bill, undermining budget-balancing pledges.

Fiscal duplicity: while touting deficit reduction via DOGE and other means, Republicans rely on a $2.25 trillion deficit increase to finance the bill, undermining budget-balancing pledges.

What’s the caveat?

The bill still needs to pass the Senate where it still faces hurdles. Swing-state senators with a working class base and fiscal hawks (e.g., Maine’s Collins) may block it over entitlement cuts and deficit concerns. Passage is far from guaranteed.

finformant view

Trump’s 2024 victory rested on working-class voters angered by inflation, immigration and Democratic wokeness. Cutting their safety net likely backfires via lower approval ratings and could put the GOP Congress majority in ‘26 in danger.