First Data Shows What Impact to Expect from Tariffs

What happened?

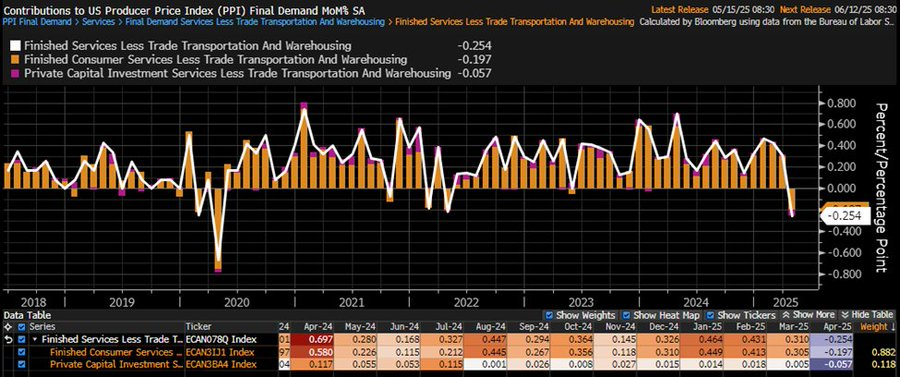

Yesterday's producer price data for April provided an early indication of the potential impact of tariffs on future economic activity. Overall, producer prices fell more than at any time since the early days of the pandemic. Although prices for goods increased slightly due to tariffs, this increase was offset by price declines for discretionary services (e.g., flights) and a significant decline in "transfer services." This obscure line item is corporate margin. In other words, corporations decided not to pass the tariff cost on to consumers.

Why does this matter?

-

Tariff damage is real: The PPI data removes doubt about a negative real economy impact.

Tariff damage is real: The PPI data removes doubt about a negative real economy impact.

-

Tariffs may be deflationary: While prices went up for items affected by tariffs, consumers did not have more money in their pocket than before, so they saved elsewhere.

Tariffs may be deflationary: While prices went up for items affected by tariffs, consumers did not have more money in their pocket than before, so they saved elsewhere.

What’s the counterpoint?

-

If tariffs are deflationary, the Fed can cut rates: Chair Jerome Powell has held back on rate cuts due to a fear of tariffs being inflationary.

If tariffs are deflationary, the Fed can cut rates: Chair Jerome Powell has held back on rate cuts due to a fear of tariffs being inflationary.

-

Tax cuts will balance tariff pain: Currently, it seems likely that Trump's "big, beautiful" tax bill will pass both the House and the Senate. If the bond market doesn't reject it, the bill could provide significant stimulus and offset the impact of tariffs.

Tax cuts will balance tariff pain: Currently, it seems likely that Trump's "big, beautiful" tax bill will pass both the House and the Senate. If the bond market doesn't reject it, the bill could provide significant stimulus and offset the impact of tariffs.

finformant view

The April PPI data likely serves as a blueprint for how tariffs will impact the economy. Tariffs are bad for consumption and corporate margins and are likely to be deflationary. Now, all eyes are on the tax bill and the bond market to see if they can offset this economic drag.