Bond Tantrum at Its Peak?

What happened?

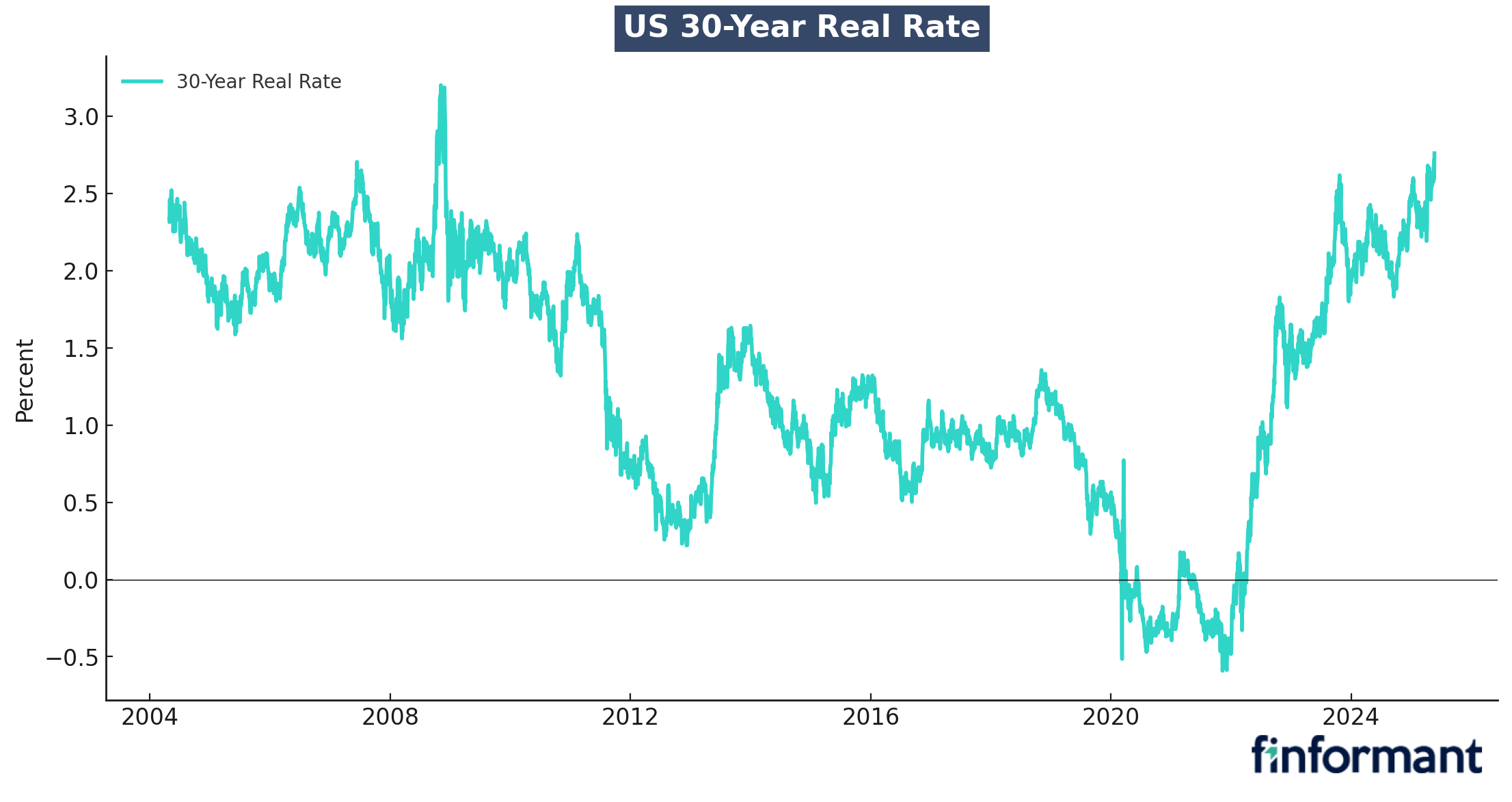

This morning, the House of Representatives passed the "Big Beautiful" tax bill by a one-vote majority. The Senate will consider it in the coming weeks and then turn it into law. In response, bond markets experienced another selloff, pushing the 30-year real rate to multi-decade highs. However, there are some signs that the bond market rout may have reached its peak.

Why could that be the case?

-

Bond yields are reflexive: Very high real rates will likely slow economic activity going forward, creating a counterbalance to the stimulative tax cuts.

Bond yields are reflexive: Very high real rates will likely slow economic activity going forward, creating a counterbalance to the stimulative tax cuts.

-

Signs of a likely US slowdown: The Supreme Court upheld several of Trump's deportation initiatives, paving the way for large-scale deportations that will reduce labor and consumer demand in the economy.

Signs of a likely US slowdown: The Supreme Court upheld several of Trump's deportation initiatives, paving the way for large-scale deportations that will reduce labor and consumer demand in the economy.

What’s the counterpoint?

-

The deficit will remain enormous: Although it is possible for the market to rebound from panic levels, the deficit will remain at record levels for a peacetime economy. There is still no structural reason to hold long-term bonds.

The deficit will remain enormous: Although it is possible for the market to rebound from panic levels, the deficit will remain at record levels for a peacetime economy. There is still no structural reason to hold long-term bonds.

-

Deportations may cease once the industry complains: As with tariffs, Trump may be receptive to feedback and reduce his deportation efforts when corporations complain about the labor supply.

Deportations may cease once the industry complains: As with tariffs, Trump may be receptive to feedback and reduce his deportation efforts when corporations complain about the labor supply.

finformant view

Bond markets are panicking, but growth may slow down from here. It's not unlikely that a local low in long-term yields has been reached.